The housing market shoud have a different behavior than the stock market. In somme way it shoue be safer. In this article, I compare one of the best REIT option O to one the most represantable stock market ETF, SPY to find out if it is worth to include O in our portfolio in terms of downside risk protection and upside potential with tthe stock market.

The full name of O is Realty Income Corporation and VNQ is SPDR S&P 500 ETF Trust.

APP

Tax Rate on Dividends:Start Date:

End Date:

Simulate Random Date 100 Times

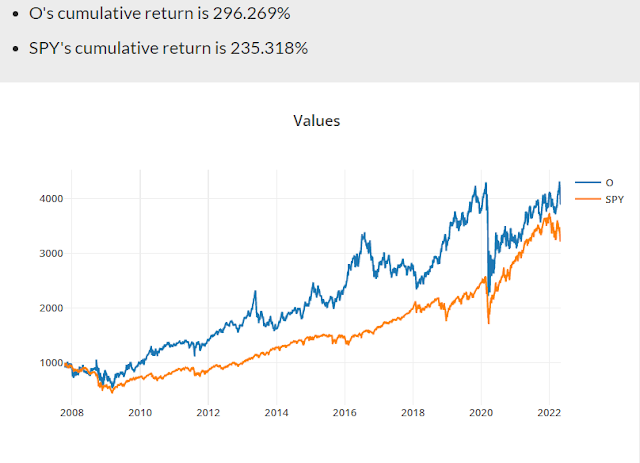

Investing During the 2008 Financial Crisis

O did better but with a higher volitility.

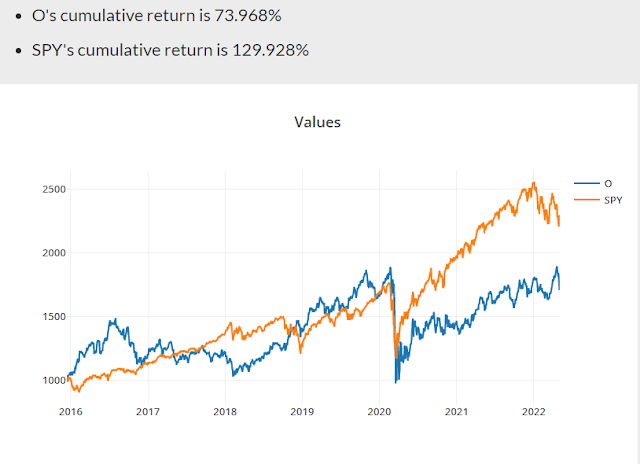

Investing During the 2020 Covid-19 crisis

O suffers more loses, which makes sense that a lot of O's assets have something to do we shopping and shoppeing is hit greatly by Covid.

Investing During the 2015 Fed's Rate Hikes

O did not do too good here.

Investing When S&P 500 hit bottom during Covid crisis

SPY grew faster than O.

Conclusion

I woudl stick with SPY for now.

Comments

Post a Comment