I frequently visit Yahoo Finance website. The reason is that it provides almot

complete historical stock data for which I use to build financial models. In

order to use the right data, I need to kwno the "Close price adjusted for

splits" and "Adjusted close price adjusted for splits and dividend and/or

capital gain distributions" that Yahoo Finance presents.

Close price adjusted for splits

If I would to use the historical prices that Yahoo Finance provides, I could

choose this column of data. But what does this mean?

Theoretically, if stock splite, it price should go down so that the total

capital of the company remains the same.

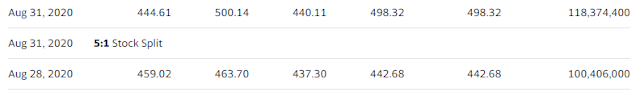

I search the company Tesla. It had a 5 for 1 stock split on Aug 31, 2020,

which means the stock price should be cut to 1 fifth. And what I have found

was that Yahoo Finance would adjust the price so just if the stock split has

never happeed.

Adjusted close price adjusted for splits and dividend and/or capital gain distributions

Now, let's take a look at the second to the last column of data which is

adjusted for both stock split and dividends.

I search SPY for answers.

What this column means is that if you use this column of data, you don't need

to calculate the reinvesment of dividends as if the stock does not pay out any

dividends.

Proof?

To quench my urge to continue looking for answer for the what "Adjusted close

price adjusted for splits and dividend and/or capital gain distributions"

means, I build an app to test if the data set with no adjustment for dividend

but with reinvestment would have the same result if I use the one with

adjustment.

Click on run, the system will pick a random date and compare for the result.

Conclusion

After playing with my own app, I am happy with the result that the adjusted closed prices at the 5th column provdided by Yahoo Finance already take care of dividends so I can use these date without doing the dividend reinvestment calculation.

Comments

Post a Comment