In this article, I want to explore which asset, ETFs, MFs, Stocks, did best during the 2008 financial crisis. I will compare the investment results against the result of SPY, since it represents the overall market. The scenario is investing right at the highest point of S&P 500 index right before it crashed during the crisis. The date is Oct 9, 2007 when the index reached 1,565.15.

I will compare the returns of each asset against SPY in the following order:

- Investing until the bottom of the crisis at 676.53 on Mar 09, 2009 in order to simulate downside risk.

- Investing until the S&P 500 index closed above the previous high at 1,568.61 on Apr 09, 2013 in order to simulate recover ability.

- Investing until the bottom of the Covid crisis at 2,304.92 on Mar 20, 2020 in order to simulate a series of market crashes.

Performance By Ranks

Oct 9, 2007 to Mar 09, 2009

- SHY return is 8.848%

- AGG return is 7.390%

- LQD return is -6.793%

- HYG return is -32.864%

- FKINX return is -44.255%

- IWF return is -51.006%

- SPY return is -55.201%

Oct 9, 2007 to Apr 09, 2013

- LQD return is 50.084%

- HYG return is 42.068%

- AGG return is 36.809%

- FKINX return is 24.798%

- IWF return is 21.978%

- SHY return is 14.425%

- SPY return is 12.755%

Oct 9, 2007 to Mar 20, 2020

- IWF return is 150.881%

- SPY return is 89.275%

- LQD return is 67.536%

- AGG return is 61.141%

- HYG return is 52.196%

- FKINX return is 37.036%

- SHY return is 25.593%

FKINX VS. SPY

- SPY return is -55.201% and FKINX return is -44.255%.

- SPY return is 12.755% and FKINX return is 24.798%.

- SPY return is 89.275% and FKINX return is 37.036%.

LQD VS. SPY

- SPY return is -55.201% and LQD return is -6.793%.

- SPY return is 12.755% and LQD return is 50.084%.

- SPY return is 89.275% and LQD return is 67.536%.

HYG VS. SPY

- SPY return is -55.201% and HYG return is -32.864%.

- SPY return is 12.755% and HYG return is 42.068%.

- SPY return is 89.275% and HYG return is 52.196%.

AGG VS. SPY

- SPY return is -55.201% and AGG return is 7.390%.

- SPY return is 12.755% and AGG return is 36.809%.

- SPY return is 89.275% and AGG return is 61.141%.

SHY VS. SPY

IWF VS. SPY

- SPY return is -55.201% and IWF return is -51.006%.

- SPY return is 12.755% and IWF return is 21.978%.

- SPY return is 89.275% and IWF return is 150.881%.

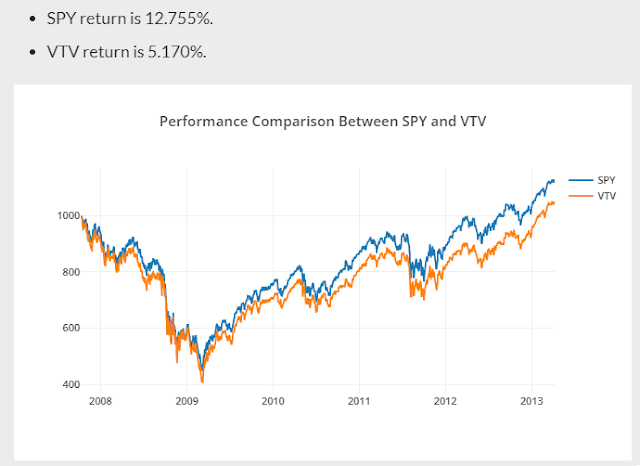

VTV VS. SPY

- SPY return is -55.201% and VTV return is -59.154%.

- SPY return is 12.755% and VTV return is 5.170%.

- SPY return is 89.275% and VTV return is 51.767%.

Comments

Post a Comment